(Zero Hedge)—Arabica coffee futures surged to record highs on Friday, fueled by the ongoing global supply crunch. The most-active contract climbed nearly 2% in late morning trading, reaching the highest price levels on record dating back to 1972. The multi-year parabolic move in coffee prices only suggests higher Starbucks and/or supermarket market prices in the months ahead if hedges fail to offset bean inflation.

The big price jump has traders reducing their exposure to the futures market due to elevated costs, making the market more prone to volatility.

-

The Importance of Prayer: How a Christian Gold Company Stands Out by Defending Americans’ Retirement

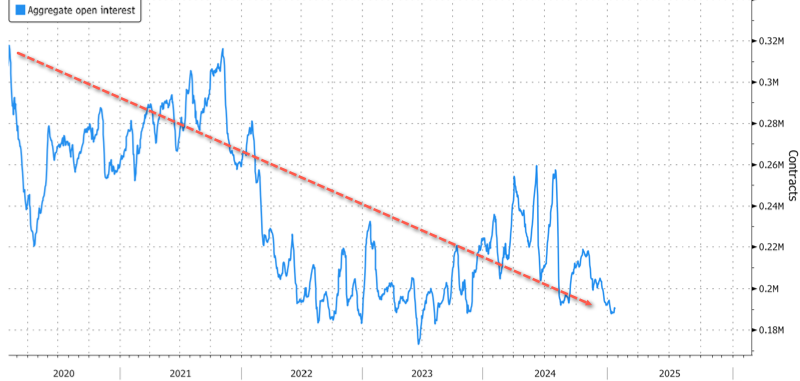

Bloomberg data shows aggregate open interest — or the number of outstanding contracts — has declined in the past five years while prices moved higher.

Bloomberg’s Dayanne Sousa and Mumbi Gitau provided readers with bean supply concerns coming out of top grower Brazil:

After record shipments in 2024, Brazil should see a slowdown ahead “mainly due to the next arabica crop likely being smaller,” analysts at Itau BBA bank wrote in a report.

That’s a concern in a period when global stockpiles remain tight. The fact that previously strong exports from Brazil weren’t enough to replenish world inventories “shows that demand has not yet allowed there to be an excess of coffee on the market,” said broker Thiago Cazarini, president of Cazarini Trading Co.

Another reminder of the tightness in global supplies was this week’s decline in bean stockpiles held at exchange- monitored warehouses. That could indicate “robust spot demand in Europe,” said Tomas Araujo, a trading associate at StoneX.

In a separate note, Bloomberg’s Ilena Peng and Mumbi Gitau said:

Prices have been boosted by concerns about the output in top producer Brazil, where a drought reduced the potential production for the upcoming season. The decline in certified arabica stockpiles held at exchange-monitored warehouses this week is another reminder of continuing supply concerns. The surge is causing nervousness among coffee buyers already faced with tight global inventories and supply chain constraints, said Tomas Araujo, a trading associate at StoneX

The bean surge should not only make commercial coffee buyers nervous but also leave consumers uneasy, as there are no indications that global food inflation will ease in the first quarter of 2025.

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.