Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 35% off!

(Zero Hedge)—There is a lot to unpack in Goldman’s note, “US Policy Implications: Reliability, AI/Data Center Power Surge, More Nuclear/Fewer EVs,” which discusses President Trump’s “energy emergency” executive orders alongside the private sector announcement of the Stargate AI infrastructure project.

Goldman analysts Brian Singer, Brendan Corbett, and others noted that despite President Trump’s executive order freezing all Inflation Reduction Act funding disbursements, they remain “bullish on multiple sustainable themes” because of corporate/consumer/policymaker/regulator priority:

- Reliability of energy, power and water supply.

- Efficiency innovation towards energy, land and resource use. AI/Data Center power demand growth and willingness by Big Tech/hyperscalers to pay Green Reliability Premiums in support of nuclear generation and multiple other Clean Reliable virtual/on-site power sourcing.

- Increased embrace by Sustainable Investors of the need for AI and Automation to fill rising labor challenges accelerated by aging populations in developed economies with tailwinds for Reskilling/Education/Womenomics stocks.

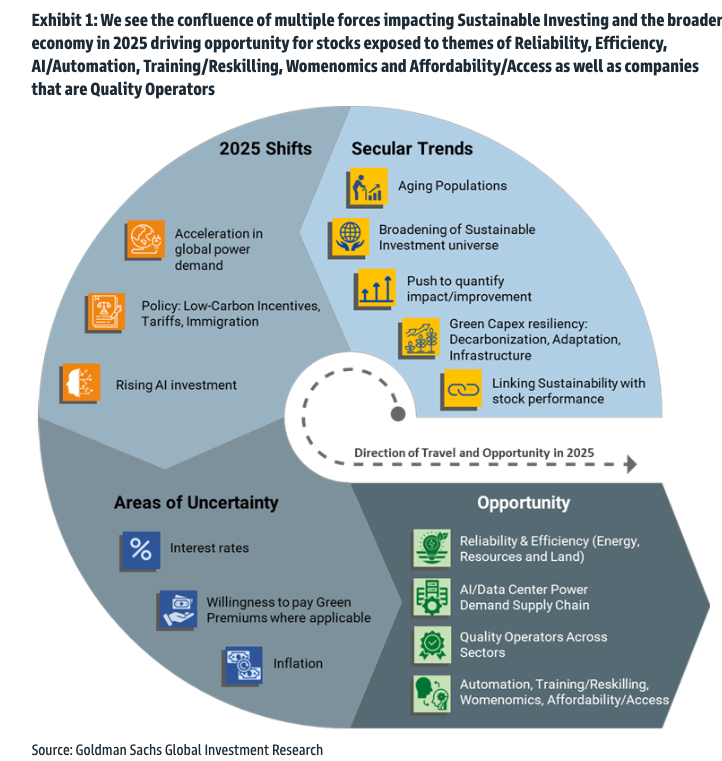

The team of analysts noted a convergence of multiple drivers impacting Sustainable Investing themes and the broader US economy in 2025 that only provides tailwinds for other themes, including “Reliability, Efficiency, AI/Automation, Training/Reskilling, Womenomics, and Affordability/Access. ”

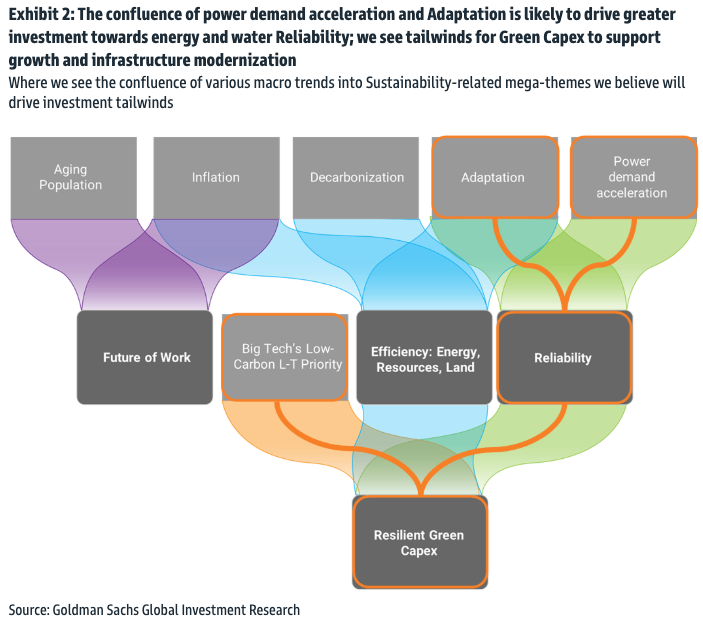

They see tailwinds for Green Capex to support growth and infrastructure modernization…

The analysts next provided a breakdown of President Trump’s executive orders related to energy and AI announced last week:

In the first days of the new US Administration, President Trump issued executive orders declaring a National Energy Emergency, reviewing wind energy permitting and promoting affordable/reliable energy and domestic natural resources.

What was broadly consistent with our prior reports. Much of the policy and priorities were in-line with discussions in Washington in October, our post-election outlook and our 2025 outlook, in particular regarding:

- Prioritizing acceleration of permitting processes for US energy/power/minerals development.

- De-emphasis on EVs and offshore wind.

- Suspension of further IRA loans/grants.

- Broad support for nuclear.

- Broad support for infrastructure/AI/data centers.

What was not consistent with our prior reports. Beyond the topics discussed in our prior reports, the executive orders issued in the opening days of the Administration:

- Call for a suspension of federal permitting for onshore wind projects pending the completion of a comprehensive assessment and review of Federal wind leasing and permitting practices.

- Pause the disbursement of funds appropriated through the Inflation Reduction Act pending a 90-day review of processes, policies, and programs for issuing grants, loans, contracts, or any other financial disbursements of such appropriated funds for consistency with the law.

- Supply and maintain a critical minerals National Defense Stockpile.

Four investment takeaways for key 2025 themes.

- In aggregate, the policy initiatives broadly support our bullish outlook for investment towards Reliability of power, energy and water which we believe will be a priority of regulators, policymakers, corporates and consumers.

- The increased focus on affordability we believe is bullish for the broad theme of Efficiency — energy, resources and land.

- Support for AI/data centers benefits companies in the supply chain of the AI/data center global power surge, in our view, including those providing low-carbon solutions.

- At the same time there remain uncertainties, most importantly over the sustainability of IRA tax incentives and outlook for federal permitting of onshore wind. Not all onshore wind projects require federal permits, suggesting greater nuance regarding company-specific impact.

The analysts turned their focus on “AI/data centers’ global power surge: Continue to see aggressive US/global growth, all-in approach to power sourcing.” This coincides with our “The Next AI Trade” note in April 2024.

Here’s more from the analysts about the data center power surge that will boost demand on the grids through the end of the decade:

Our analysis suggests a 160%-165% increase in data center power demand by 2030 vs. 2023 levels. In the US, this implies that data centers will contribute a ~1% CAGR to overall US power demand; our Utilities team in its April 2024 report expects overall US power demand CAGR of 2.4% through 2030. We see data centers adding a 0.3% CAGR to overall global power demand. Our base case implies data center power demand moves from 1%-2% of overall global power demand to 3%-4% by 2030. In the US, the pace of mix increase is even greater, more than doubling by 2030 from 4% in 2023. If global data center growth in 2030 vs. 2023 levels were its own country, it would be a top 10 global power consumer.

However.

The analysts cautioned that, amid the surge in data center power demand, five potential constraints could pose significant risks to their updated base case of a 160% jump in global data center power demand growth in 2030 vs. 2023 levels:

- Will AI server shipments be constrained by data center capacity? Our analysis led by our Telecom Infrastructure team suggests a tightening market for data center real estate in the coming years but sufficient capacity for our base case expectations for power demand.

- Will data center capacity be constrained by power infrastructure? Our analysis led by our Utilities team suggests a combination of new generation additions and greater utilization of existing capacity will be sufficient to meet data center power demand with transmission/interconnection the greatest risk. The investment split of the intended $500 bn Stargate project into AI servers vs. other infrastructure remains unclear. Broadly, we believe a $50 bn purchase of high-powered AI servers would lead to about 8-17 TWh of annual power demand, depending on power intensity of the servers purchased (new gen vs. older gen).

- Will power infrastructure be constrained by low-carbon optionality/cost? We believe Big Tech will continue to take an all-in approach to data center power sourcing, with continued willingness to pay Green Reliability Premiums while at the same time prioritizing time-to-market. We estimate the impact of major hyperscalers absorbing Green Reliability Premiums consistent with our recent AI/data center power surge report represents a modest 2%-3% of EBITDA and a minimal impact on >30% corporate returns. We note that Microsoft’s CEO noted continued intentions to achieve 2030 decarbonization objectives in a CNBC interview on January 22, and Amazon’s Chief Sustainability Officer was quoted in a press report as staying course on low-carbon goals.

- Will new-gen AI chips drive lower or higher aggregate power demand? We assume Big Tech cash flow/budgets will be the key constraint, leaving upside risk if there are no constraints and downside risk if compute speed demand is finite. We continue to see more risk to the upside (i.e., fewer capital constraints) while AI is in the training phase.

- Will AI server demand be constrained by AI results/innovations? This will remain key to watch, particularly from a Sustainability perspective whether we see accelerated efficiency solutions in the health care, energy, agriculture and education sectors.

The analysts then shifted their focus on “underinvestment in infrastructure” amid tailwinds by the Trump administration, plus ongoing power demand shift higher:

We believe the confluence of rising power demand, historical underinvestment in infrastructure and rising temperatures/more extreme weather events will continue to drive rising tailwinds for investments in Reliability — primarily of Power/Energy and Water. We continue to see opportunity for investment in stocks levered to the theme globally, which we believe will be a priority for both policymakers and corporate/residential consumers.

Infrastructure replacement and hardening both necessitate Reliability investment. Our meetings with corporates, regulators and policymakers in 2024 indicated increased recognition of the need for grid/water infrastructure hardening and modernization. This is due to both underinvestment in recent years as well as a wider range of expected temperatures between summer and winter. We believe both policymakers and regulators will look to reduce risk of outages and as such prioritize measures that would improve Reliability and Resiliency.

Adaptation will likely be a rising theme regardless of climate outcome, in our view. We believe the growing realization of potential risks/impacts/opportunities as global temperatures rise will serve to further investor and corporate focus on Adaptation. Since 1970, the world has seen an acceleration in temperature rise vs. the 1850-1900 average, per Berkeley Earth data. In the near to medium term we believe investors and corporates will take increased measures to quantify physical risks, increase investments towards Adaptation mitigation/solutions and look for new ways of gaining exposure to Adaptation solutions. Our meetings with regulators and corporates suggest recognition of the need to invest to mitigate Reliability risk from extreme weather events or more volatile summer/winter temperatures via investment in water/power solutions.

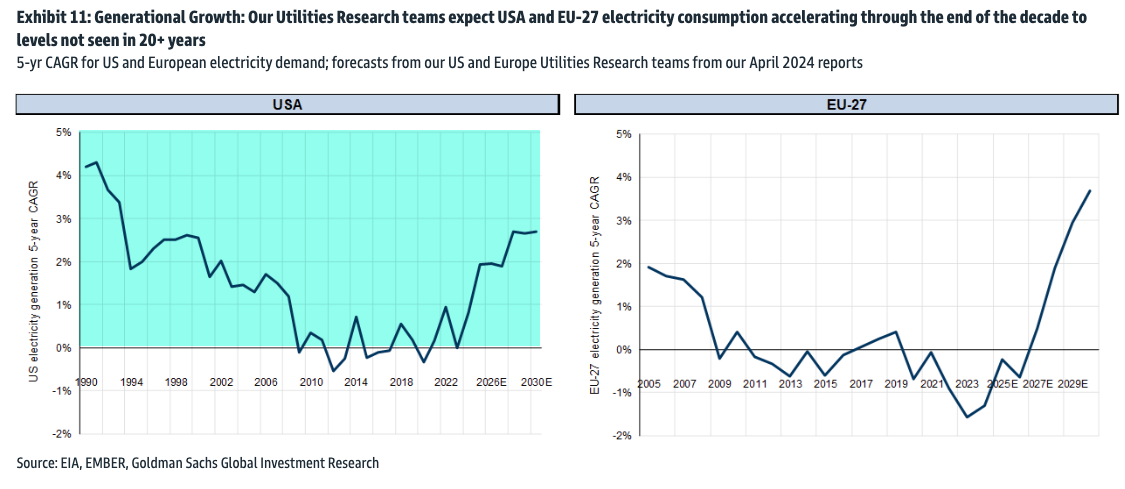

Generational growth will act as a further tailwind for infrastructure spending. We expect electricity demand growth in the US and Europe to accelerate to levels not seen in a generation, a function of electrification (Europe and US), AI/broader data center demand (US and Europe) and industrialization/reshoring (US). Also, with an eye on reducing risk of outages, we believe regulators will support investments to meet rising demand, with particular support for affordable technologies that advance meeting demand and reliability goals. We also see regionalization driving increased water infrastructure needs in select geographies.

Reliability a driver of recent US power M&A. On January 10, Constellation Energy (CEG, Coverage Suspended) announced plans to acquire privately held company Calpine, which would fuse Constellation’s largely nuclear generation fleet with Calpine’s largely natural gas generation fleet. The companies in their statement announcing the deal highlighted the increased need for Reliability amid rising demand growth, in particular from data centers.

Goldman’s Utilities Research teams provided their outlook on US electricity consumption…

To conclude, the analysts said a more significant shift is underway within the Trump era: “Accelerated nuclear generation expansion combined with reductions in incentives for electric vehicles in the US may not derail overall Green Capex while potentially leading to net lower long-term carbon emissions.”

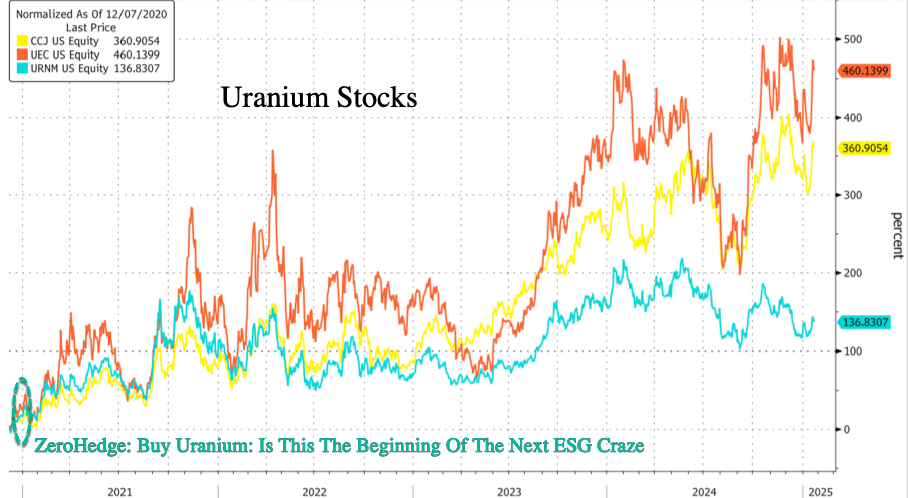

Let’s not forget that in December 2020, one of our major themes was the nuclear trade.

Separately, on Saturday, we provided readers with Michael Hartnett’s latest Flow Show, which shows the 10 biggest themes through the end of the decade.

Five Things New “Preppers” Forget When Getting Ready for Bad Times Ahead

The preparedness community is growing faster than it has in decades. Even during peak times such as Y2K, the economic downturn of 2008, and Covid, the vast majority of Americans made sure they had plenty of toilet paper but didn’t really stockpile anything else.

Things have changed. There’s a growing anxiety in this presidential election year that has prompted more Americans to get prepared for crazy events in the future. Some of it is being driven by fearmongers, but there are valid concerns with the economy, food supply, pharmaceuticals, the energy grid, and mass rioting that have pushed average Americans into “prepper” mode.

There are degrees of preparedness. One does not have to be a full-blown “doomsday prepper” living off-grid in a secure Montana bunker in order to be ahead of the curve. In many ways, preparedness isn’t about being able to perfectly handle every conceivable situation. It’s about being less dependent on government for as long as possible. Those who have proper “preps” will not be waiting for FEMA to distribute emergency supplies to the desperate masses.

Below are five things people new to preparedness (and sometimes even those with experience) often forget as they get ready. All five are common sense notions that do not rely on doomsday in order to be useful. It may be nice to own a tank during the apocalypse but there’s not much you can do with it until things get really crazy. The recommendations below can have places in the lives of average Americans whether doomsday comes or not.

Note: The information provided by this publication or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.

Secured Wealth

Whether in the bank or held in a retirement account, most Americans feel that their life’s savings is relatively secure. At least they did until the last couple of years when de-banking, geopolitical turmoil, and the threat of Central Bank Digital Currencies reared their ugly heads.

It behooves Americans to diversify their holdings. If there’s a triggering event or series of events that cripple the financial systems or devalue the U.S. Dollar, wealth can evaporate quickly. To hedge against potential turmoil, many Americans are looking in two directions: Crypto and physical precious metals.

There are huge advantages to cryptocurrencies, but there are also inherent risks because “virtual” money can become challenging to spend. Add in the push by central banks and governments to regulate or even replace cryptocurrencies with their own versions they control and the risks amplify. There’s nothing wrong with cryptocurrencies today but things can change rapidly.

As for physical precious metals, many Americans pay cash to keep plenty on hand in their safe. Rolling over or transferring retirement accounts into self-directed IRAs is also a popular option, but there are caveats. It can often take weeks or even months to get the gold and silver shipped if the owner chooses to close their account. This is why Genesis Gold Group stands out. Their relationship with the depositories allows for rapid closure and shipping, often in less than 10 days from the time the account holder makes their move. This can come in handy if things appear to be heading south.

Lots of Potable Water

One of the biggest shocks that hit new preppers is understanding how much potable water they need in order to survive. Experts claim one gallon of water per person per day is necessary. Even the most conservative estimates put it at over half-a-gallon. That means that for a family of four, they’ll need around 120 gallons of water to survive for a month if the taps turn off and the stores empty out.

Being near a fresh water source, whether it’s a river, lake, or well, is a best practice among experienced preppers. It’s necessary to have a water filter as well, even if the taps are still working. Many refuse to drink tap water even when there is no emergency. Berkey was our previous favorite but they’re under attack from regulators so the Alexapure systems are solid replacements.

For those in the city or away from fresh water sources, storage is the best option. This can be challenging because proper water storage containers take up a lot of room and are difficult to move if the need arises. For “bug in” situations, having a larger container that stores hundreds or even thousands of gallons is better than stacking 1-5 gallon containers. Unfortunately, they won’t be easily transportable and they can cost a lot to install.

Water is critical. If chaos erupts and water infrastructure is compromised, having a large backup supply can be lifesaving.

Pharmaceuticals and Medical Supplies

There are multiple threats specific to the medical supply chain. With Chinese and Indian imports accounting for over 90% of pharmaceutical ingredients in the United States, deteriorating relations could make it impossible to get the medicines and antibiotics many of us need.

Stocking up many prescription medications can be hard. Doctors generally do not like to prescribe large batches of drugs even if they are shelf-stable for extended periods of time. It is a best practice to ask your doctor if they can prescribe a larger amount. Today, some are sympathetic to concerns about pharmacies running out or becoming inaccessible. Tell them your concerns. It’s worth a shot. The worst they can do is say no.

If your doctor is unwilling to help you stock up on medicines, then Jase Medical is a good alternative. Through telehealth, they can prescribe daily meds or antibiotics that are shipped to your door. As proponents of medical freedom, they empathize with those who want to have enough medical supplies on hand in case things go wrong.

Energy Sources

The vast majority of Americans are locked into the grid. This has proven to be a massive liability when the grid goes down. Unfortunately, there are no inexpensive remedies.

Those living off-grid had to either spend a lot of money or effort (or both) to get their alternative energy sources like solar set up. For those who do not want to go so far, it’s still a best practice to have backup power sources. Diesel generators and portable solar panels are the two most popular, and while they’re not inexpensive they are not out of reach of most Americans who are concerned about being without power for extended periods of time.

Natural gas is another necessity for many, but that’s far more challenging to replace. Having alternatives for heating and cooking that can be powered if gas and electric grids go down is important. Have a backup for items that require power such as manual can openers. If you’re stuck eating canned foods for a while and all you have is an electric opener, you’ll have problems.

Don’t Forget the Protein

When most think about “prepping,” they think about their food supply. More Americans are turning to gardening and homesteading as ways to produce their own food. Others are working with local farmers and ranchers to purchase directly from the sources. This is a good idea whether doomsday comes or not, but it’s particularly important if the food supply chain is broken.

Most grocery stores have about one to two weeks worth of food, as do most American households. Grocers rely heavily on truckers to receive their ongoing shipments. In a crisis, the current process can fail. It behooves Americans for multiple reasons to localize their food purchases as much as possible.

Long-term storage is another popular option. Canned foods, MREs, and freeze dried meals are selling out quickly even as prices rise. But one component that is conspicuously absent in shelf-stable food is high-quality protein. Most survival food companies offer low quality “protein buckets” or cans of meat, but they are often barely edible.

Prepper All-Naturals offers premium cuts of steak that have been cooked sous vide and freeze dried to give them a 25-year shelf life. They offer Ribeye, NY Strip, and Tenderloin among others.

Having buckets of beans and rice is a good start, but keeping a solid supply of high-quality protein isn’t just healthier. It can help a family maintain normalcy through crises.

Prepare Without Fear

With all the challenges we face as Americans today, it can be emotionally draining. Citizens are scared and there’s nothing irrational about their concerns. Being prepared and making lifestyle changes to secure necessities can go a long way toward overcoming the fears that plague us. We should hope and pray for the best but prepare for the worst. And if the worst does come, then knowing we did what we could to be ready for it will help us face those challenges with confidence.